Blog

5 Reasons to Invest in a Multi Family Property

May 3, 2023

Residential real estate is broken down into single family homes and multi family properties. A single family home is a building that can accommodate one tenant at a time. On the other hand multi family properties have more than one unit and can house a number of tenants at once.

The multi family property category can range from multiplexes with a handful of units to apartment buildings that can be a home to hundreds of tenants. Investors are often drawn in by the prospect of the added income from more units. While these properties do come at a higher initial investment, they can be well worth it.

Multi family property investments are often considered to have better returns. They are more economical and tend to be a safer investment. Here are our top 5 reasons to invest in a multi family property.

1. Benefit From Economies of Scale

Multi Family properties are usually more efficient allowing you to reap the benefits from the economies of scale. While multi family properties tend to be more expensive as a whole, the cost per unit is generally lower than with single family properties. This is also true in terms of maintenance and management costs.

It is more economical to maintain a multi family property and you also gain negotiating power with your vendors and suppliers. The maintenance contract for an apartment building is much more lucrative than a few single family homes scattered throughout the city. In this way you can get better rates from your contractors and discounts for products that you regularly buy.

Economies of scale allow you to spread out costs over a larger number of units thereby giving you a higher return on your investment. This applies to the initial purchase and also for further investments you make in amenities and upgrades. Adding features and amenities that multiple tenants can enjoy allows you to grow your income with only incremental additional costs.

2. Steady Cash Flow

The problem with single family homes is that they come with just one income stream. If that one tenant moves out the property becomes 100% vacant and there is no cash coming in. It’s an all or nothing scenario and it can be risky.

On the other hand a multi family property investment has several different tenants contributing to the steam of income. If one tenant moves out of a ten unit building then that property is still only 10% vacant. Multiple tenants serve as a safety net for your cash flow.

A more stable cash flow makes it easier to overcome unforeseeable situations that may negatively impact your business. This makes multi family properties more stable during economic downturns. That is why multi family property investments are considered to have less risk.

3. Easier to Finance

Many investors cite the high purchase price as an obstacle to securing a multi family property investment. While it’s true that these properties usually come with a price tag in the millions, they are often easier to finance. Financial institutions are actually significantly more likely to approve a loan for a multi family property.

The steady cash flow and reduced risk rendered by multiple income streams makes banks view multi family property investments more favorably. Even with a few vacant units the building owner is still probably going to be able to make their mortgage payments. Lower risk means it’s easier to secure financing and you are more likely to be offered a more competitive rate as well.

4. Grow Your Portfolio Faster

It is much easier to acquire one ten unit apartment building rather than ten separate single family homes. Each property has to be found and inspected before you even make an offer. That’s at least ten rounds of negotiations and paperwork which takes time and effort.

Multi family property investments are more expensive overall but their per unit price is usually lower. Those ten single family homes will probably end up costing significantly more than the ten unit building. Purchasing a multi family property allows you to add more units to your portfolio giving you more for your investment dollars.

Once you have your first multi family property you can enjoy the benefits of scale allowing you to be more economical with your money. You can start saving for your next property a little faster allowing you to compound returns more quickly. Multi family properties are a great investment for those who want to rapidly scale their business.

5. Easier To Manage

The cost of management is significantly higher for single family properties. Each home is unique and requires individual attention. Every property will need to have its own maintenance schedule and tailor made marketing strategy.

Furthermore single family properties are likely to be scattered making it more difficult to connect with tenants and keep an eye on the property. If a tenant has a complaint the property manager will have to make the trip out to the property. This can be especially cumbersome in an emergency and that can lead to greater losses.

Larger multi family properties can have staff on-site. This allows for greater control and a more in-depth understanding of the property and the tenants who live there. Having someone there at all times allows you to improve the quality of service that your tenants receive while reducing costs.

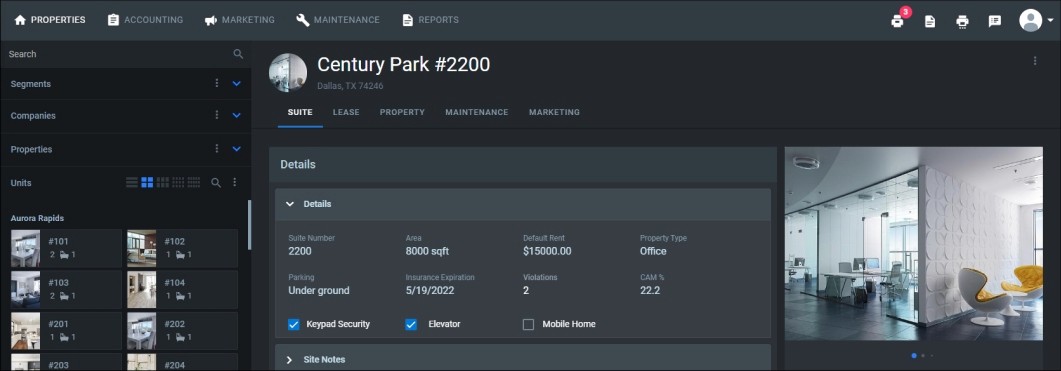

Multi family properties can easily be managed with Property Matrix. Build a strong tenant community with building pages and tenant portals. A suite of tools and comprehensive accounting software makes property management a breeze.