Blog

Can your Tenants Pay Online? 8 Reasons They Need to Be

Mar 9, 2023

Accepting online payments provides tenants with an easy and reliable way to pay their rent and other bills. This method of payment saves time, improves tenant satisfaction, enhances efficiency, and reduces costs. If your tenants aren’t paying online, they should be.

Accepting online payments makes a property manager look more professional and improves the relationship with tenants. This effective tool can empower you to be better organized making you a trustworthy and reliable landlord. Additionally, providing the convenience of online payments shows that you value your tenants.

Getting set up with online payments is easy and it’s worth it. The benefits extend to you and your renters. If your tenants aren’t paying online, here are eight reasons why they need to be.

1. Easy and Convenient For Tenants

We’re all leading busy lives. Online payments are quick, easy, and very convenient making them more compatible with hectic lives. Tenants can pay their bills from anywhere they have access to the internet. There are no office hours for online payments so tenants can easily fit them into their stretched schedules.

Most tenants appreciate the option to pay online because it is the quickest and easiest method to get paying the bills checked off their to-do list. The ability to pay rent and other bills from the comfort of home may be the perk that a tenant looks for before signing the lease. Accepting rent payments by credit card or ACH payments can give you a competitive advantage.

2. Get Paid Faster

Most people would rather not fall behind on their bills but if making a payment is a hassle tenants may simply want to avoid the chore. Providing an easy alternative such as online payments can remove that barrier to getting your money. Tenants are more likely to take care of a bill right away if making the payment is easier than remembering to do it later.

Online payments are promptly and automatically deposited into your account. You have access to the funds right away and there are no delays due to processing or snail mail. Quicker payments means better cash flow and cleaner books.

3. Reduced Collections Activities

Making it easier for tenants to pay their bills leads to faster payments and cleaner books which reduces the need for collections. Having fewer tenants in arrears means a smaller number of outstanding invoices to follow up on. This can positively affect your bottom line and reduce the burden on your staff.

Fewer payment reminders and reduced collections calls is better for the landlord-tenant relationship too. Nobody likes to be told that their bills are past due and nobody likes to ask for money either. Giving people every opportunity to pay on time leads to a more pleasant relationship with your tenants.

4. Fewer Errors

Online payments can be linked with your property management software to update your records automatically whenever a payment is made. This eliminates the need for data entry and reduces the human errors that come with it. There are also no NSF cheques which can make a mess of your books and lead to discrepancies.

5. Improved Customer Service

Payments made by cash or cheque can be delayed by mail and processing. Once these payments are received they must be deposited and your records must be updated manually. Online payments are instantaneous and your books can be updated automatically the moment that a tenant pays a bill.

Having accurate and up to date records puts you in a better position to reply to tenant inquiries. It shows that you know your stuff and builds credibility with tenants. They may even be able to answer their own questions by viewing their online payment history.

6. Easy To Track

Payments made by cash or cheque can be lost in the mail, forgotten on someone’s desk, or applied to a wrong account. Online payments are easy to track down and are automatically applied to the tenant account they are linked with. It’s easier to prove if a bill was or wasn’t paid making dispute resolution a simpler process.

7. Improved Security

Online payments can’t go missing before they even reach you the way that cash or cheques can. Tenants who send their payment by mail risk having them lost in transit. Even if they bring their payments to the office they may still get misplaced but online payments are always secure.

Whenever a payment goes missing there is the opportunity for it to fall into the wrong hands. Cheques can be used for fraud and identity theft with the possibility of negative consequences not only for your tenant but also for your business and your employees. If your office is taking a lot of cash payments you increase the odds of being robbed and not only losing all the cash you’re holding but also risking a serious data breach.

8. Reduce Costs

Reducing costs without sacrificing value is an objective for every business. Online payments can help you achieve this goal by reducing your transaction and payment processing fees down to zero. With the right tools it is possible to have online payment functionality with no fees at all.

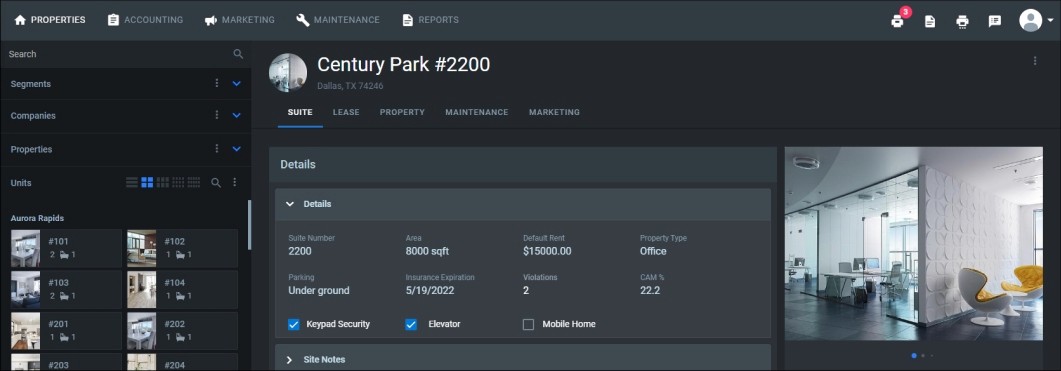

Property Matrix can help you reap all the rewards of online payments with no additional costs to you, but that’s not all. State of the art accounting software and powerful property management tools designed to help you succeed and grow. Find out what Property Matrix can do for your business.