Blog

The 5 Most Profitable Property Types

Sep 28, 2022

The biggest question for investors is which property will be the most profitable. Different property types come with different rents but profitability isn’t as simple as the amount a landlord can charge per square foot or invested dollar. The issues each property presents can translate into expenses or loss of revenue and these will affect profitability.

The most profitable type of property comes down to what kind of landlord an investor wants to be and what resources and finances they have available. The ideal property for an investor with a handful of properties and limited support staff won’t be the same as for a multi-million dollar investor with a full time property management crew. The most profitable property type for you depends on what kind of investor you are.

1. Condominiums

Condos can be a good option for smaller investors who are looking to expand their portfolios. Although they can be very expensive, it is also possible to find some that are less costly than other types of rental properties. A lower initial investment allows investors with limited resources to expand their business more aggressively.

Small scale investors can also enjoy the lower maintenance that condominiums offer. The condo association takes care of all external repairs and maintenance freeing up time for the do it yourself investor. It also makes it easier to budget when a landlord’s out of pocket expenses for maintenance costs are substantially reduced.

In many ways condos come with a safety net for investors. The owner is not responsible for most big repairs and projects reducing the chance of something catastrophic coming up. In some cases even utilities and taxes are covered by the condo association so if there are sudden changes or a tenant is frivolous the investor doesn’t have to carry the burden alone.

All of these perks of condos come at a price and that is represented by the condominium fee. This fee must be paid and will take a chunk out of an investor’s income. Condos also tend to bring in lower rents and they appreciate more slowly than other types of single family homes.

2. Single Family Homes

Single family homes can be affordable for investors with modest budgets. They are usually more expensive than condos but offer a better chance at a greater return when it’s time to sell. Single family homes also tend to bring in higher rents than condos making it possible to carry a larger mortgage.

This type of dwelling tends to attract families looking to settle down. For this reason single family homes often have more long-term renters. This means lower expenses related to finding new tenants and preparing the home for the next renter as well as less time carrying vacant units.

Long-term renters often take more pride in their homes and take better care of them. They plan to stay there for a while and they want a nice place to live in. These types of tenants are also more likely to pay their rent on time as they don’t want to jeopardize their home.

Much of the maintenance that single family homes require falls on the landlord. Managing multiple properties can be labor intensive making them a poor choice for investors who are already struggling with time management. Properties are more likely to be scattered across a large area making single family homes even more difficult to manage.

3. Commercial Properties

Commercial spaces are generally one of the more profitable property types. The rent that can reasonably be charged on a commercial property is often considerably higher than on residential properties of a similar size. They can be a very good source of revenue.

In many cases the tenant is a business instead of an individual. They are familiar with contracts and are more likely to pay their rent on time as well as follow the rules specified on the lease. Commercial tenants tend to stay a while in a property that is working for their business and they usually maintain the property well as it affects their image.

Unfortunately commercial properties are often out of reach for the smaller investor. They are generally more expensive to purchase and require more experience to manage. Although commercial tenants have a tendency to stay longer, when they do leave it can be more difficult to find a replacement. Commercial properties tend to sit vacant longer and that can be detrimental to the less robust portfolio of a small investor.

4. Multi Family Homes

Multi Family Homes are considered the best investment in terms of cash flow. With multiple tenants paying rent the risks of vacant units are reduced. Even if one unit is empty the landlord can still collect rent from the other tenants.

These types of properties can generate a stronger profit than single family homes and they offer a good return on investment. They are a little easier to manage because units are at one address rather than having properties scattered across the city. Some maintenance costs are reduced due to efficiencies such as having one roof and one HVAC system instead of redundant systems across multiple single family properties.

Having multiple tenants at one address can relieve some pressures while raising others. There is more potential for tenants to have issues with each other and one bad tenant can ruin it for everyone else. Additionally it is very difficult to find a multi family property at an affordable price making it more difficult for investors on a budget.

5. Short Term Rentals

Short term rental properties have the potential to be the most profitable investments of all. They are short term leases lasting for less than a year or they can be vacation rentals being leased on a weekly or even daily basis. The rent that can reasonably be charged for these kinds of units is much higher than in any other type of property.

Properties suited to short term rentals can be purchased at a very affordable price or they can be luxurious and expensive. For this reason they are perfectly suitable for investors with different budgets. However, it is important to set aside some extra funds because this type of property is usually rented fully furnished.

Short term rentals can be a good way to grow a property management business if the investor is willing to put in the time and effort. It will be necessary to advertise often and aggressively in order to ensure that the property doesn’t sit vacant. Each unit will also have to be cleaned between renters and maintenance costs can be high because short term tenants don’t always have respect for the property.

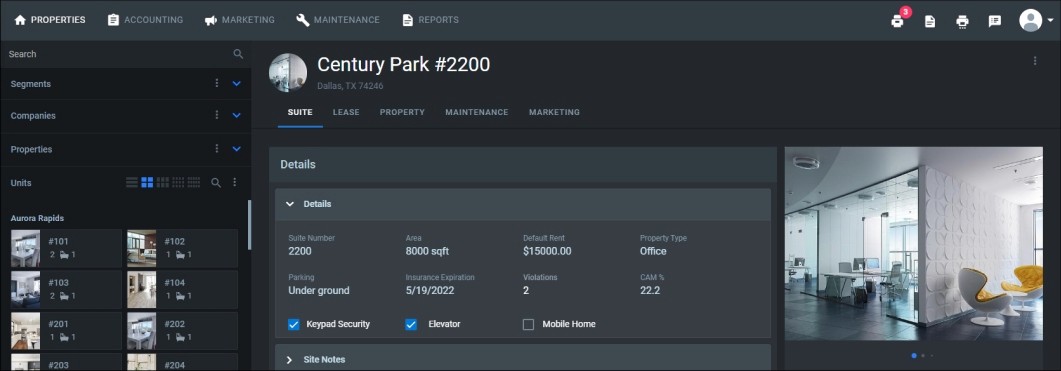

It’s important to assess the profitability of a property when trying to grow a portfolio but consider the whole picture. If you need a little help understanding the finer details of your property management business, consider investing in tools such as Property Matrix. This robust software can help you understand the profitability of your properties and track how your investments are working for you.